The US Department of the Treasury recently reported that 5 million checks continue to be mailed to federal beneficiaries each month. With just two months remaining until the March 1 electronic payment law goes into effect, the Treasury Department is urging Social Security and other federal benefit recipients to not delay and switch now to either direct deposit or the Direct Express® Debit MasterCard® card.

“Choosing direct deposit or the Direct Express® card makes it easier, safer and more convenient for beneficiaries to receive their payments. Switching to an electronic payment is not optional – it’s the law,” said David Lebryk, commissioner of the Treasury Department’s Financial Management Service. “If you or a loved one still receive paper checks for your benefit payments, now is the time to switch. It’s free and easy – just call 1-800-333-1795 or visit www.GoDirect.org.”

Converting the remaining paper check recipients to electronic payments will save American taxpayers $1 billion over the next 10 years.

The Treasury Department published a final rule in December 2010 to gradually phase out paper checks for federal benefit payments. Since May 1, 2011, all people newly applying for federal benefits, including Social Security, SSI, Veterans Affairs, Railroad Retirement Board, Office of Personnel Management benefits and other non-tax payments, have had to choose direct deposit or the Direct Express® card at the time they sign up for their benefits. March 1, 2013, is the final deadline by which all remaining federal benefit check recipients must receive their money electronically.

Check recipients can sign up for direct deposit or the Direct Express® card by calling toll-free 1-800-333-1795, visiting www.GoDirect.org, or talking to their local federal paying agency office. The process is fast, easy and free.

• By taking a few minutes to gather the necessary information ahead of time, most federal benefit recipients can sign up for electronic payments with one phone call.

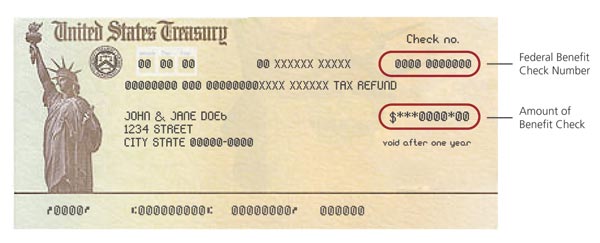

• Individuals will need their Social Security number or claim number, their 12-digital federal benefit check number and the amount of their most recent federal benefit check. If choosing direct deposit, recipients also will need their financial institution’s routing transit number, (often found on a personal check) account number and account type (checking or saving).

• There are no sign-up fees or monthly fees to receive benefits electronically.